What are Fat Tails in Trading?

Some people subscribe to the efficient market theory, which posits that markets operate in a perfectly rational and efficient manner. However, while markets are indeed competitive, large price movements occur far more often than this theory predicts. These deviations, often termed “fat tails,” have profound implications for traders and investors.

Trading revolves around price movements, and sometimes these movements can be extreme. Such occurrences, known as fat tails, can lead to either substantial profits or significant losses, depending on how the associated risks are managed. Understanding fat tails is crucial for navigating the unpredictable nature of financial markets.

If you’re looking to learn about fat tails, how to manage the risks they pose, and even capitalize on their potential, this guide will walk you through the essentials.

Table of Contents

- Definition of Fat Tails

- What Are Fat-Tailed Distributions?

- The Impact of Fat Tails in Trading

- Managing Fat Tail Risk

- Profiting from Fat Tails

- Examples of Fat Tails in Financial History

- Strategies for Incorporating Fat Tail Analysis

- Statistical Analysis of Fat Tails

- Behavioral Aspects of Fat Tails

- Technological Contributions to Fat Tails

- Fat Tails Across Asset Classes

- Case Studies: Learning from Fat Tails

- Advanced Hedging Techniques

- Practical Tips for Traders

- Using Tools to Detect Fat Tails

- Emerging Markets and Fat Tails

- Historical Patterns in Fat Tails

- Frequently Asked Questions (FAQs)

- Wrapping Up

Definition of Fat Tail

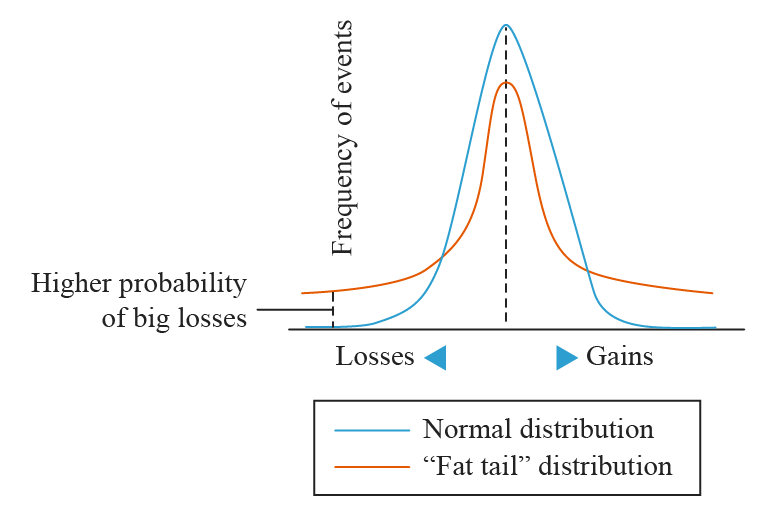

Fat tails refer to extreme price movements that occur at the edges of a probability distribution of returns. To visualize this, consider taking the daily closing prices of a financial instrument over a year. If you plot these returns on a chart, most data points will cluster around the mean, forming a bell-shaped curve. However, extreme price movements—both large gains and significant losses—occur at the far ends of the distribution.

These tails are “fat” because they represent a higher frequency of extreme outcomes than would be expected in a normal distribution. Understanding fat tails helps traders anticipate and prepare for rare but impactful events.

What are Fat Tailed Distributions?

Financial Market Returns

Returns are the percentage change in price over a specific period, and they form the foundation of financial analysis. Traditional economic models often assume that returns follow a normal distribution, where most outcomes cluster around the average, with extreme events being exceedingly rare.

However, real-world data shows that financial markets experience extreme events more frequently than normal distribution models would predict. This divergence highlights the need for models that account for fat-tailed distributions, such as the Pareto distribution or power-law models.

Tail Risk

Tail risk refers to the probability of extreme deviations from the mean price. These risks are represented graphically at the distribution’s edges and can stem from “knowable uncertainties” (e.g., geopolitical events) or “unknown unknowns” (e.g., black swan events).

While historical data can provide insights into the likelihood of fat tails, it is essential to recognize that future events may differ significantly from past occurrences. Fat tails can be even “fatter” than anticipated, underscoring the unpredictability of financial markets.

The Impact Of Fat Tails In Trading

Most trading strategies are developed based on experience or perhaps data sets (for the quantitative traders out there), both of which rely on historical data.

Since fat tails encompass the distant, but not impossible probability of extreme events occurring, fat tails skew risk metrics and are arguably largely unquantifiable.

Effects On Risk Calculations

Many risk management tools rely on assumptions of normal distributions. Metrics like the Sharpe ratio, which uses standard deviation as a risk proxy, may underestimate the probability and impact of extreme events. This can result in a false sense of security.

For example, a trader calculating position size based on the Average True Range (ATR) might miss the potential for extreme price gaps during a tail event. Adjusting calculations to account for these possibilities is critical. A common rule of thumb is to multiply ATR values by a factor (e.g., 2 or 3) to add a margin of safety.

Portfolio Implications

Fat tails can significantly skew portfolio returns. A single extreme event can overshadow years of consistent performance. This asymmetry makes it vital for traders to stress-test their portfolios against potential tail events and consider hedging strategies.

Risk of Overfitting

Quantitative traders using algorithmic strategies should be cautious of overfitting models to historical data. Fat-tailed events can invalidate overly optimized strategies, emphasizing the need for robustness in system design.

Managing Fat Tail Risk

While it’s impossible to eliminate tail risk entirely, traders can adopt strategies to mitigate its impact. Here are some practical approaches:

Use Stop Losses

Stop losses are predefined orders to exit a trade when the price reaches a certain level. By limiting losses, stop orders help traders manage their downside risk. However, during extreme events, slippage can occur, meaning the exit price might differ from the stop level. To account for this, traders should:

- Place stops at levels that invalidate the trade setup.

- Size positions conservatively to withstand potential slippage.

You can read more about stop losses in our Complete Guide to Stops.

Buy Options

Options can serve as an effective tool for managing tail risk. For example:

- Puts provide the right to sell an asset at a predetermined price, protecting against downside risk.

- Calls offer the right to buy an asset, which can be useful for protecting short positions.

When implied volatility is low, options are relatively inexpensive, making them an attractive choice for hedging or speculative purposes.

Diversify Your Portfolio

Diversification can reduce the impact of a single tail event on your overall portfolio. By allocating assets across uncorrelated markets or instruments, traders can spread risk.

Leverage Insurance Strategies

Portfolio insurance, such as dynamic hedging or volatility targeting, can help mitigate the effects of fat tails. These strategies involve adjusting exposure dynamically based on market conditions.

Profiting from Fat Tails

Fat tails don’t just pose risks—they also present opportunities for profit. Traders who position themselves correctly can capture outsized returns during extreme market moves.

Trend-Following Strategies

Trend-following strategies capitalize on momentum by trading in the direction of price movements. These strategies often use indicators like moving averages or breakout levels to identify trends. By cutting losses short and letting profits run, trend-followers aim to capture the positive tails of a distribution.

Volatility Exploitation

Periods of low volatility often precede significant market moves. Traders can use this insight to position themselves for potential breakouts. For instance, buying options during low-volatility periods provides inexpensive exposure to large price movements.

Tail Event Funds

Some hedge funds specialize in strategies designed to profit from fat tails. These funds often employ option spreads, volatility arbitrage, or tail-risk hedging to capitalize on extreme market events.

Using Tools to Detect Fat Tails

Modern trading platforms offer advanced analytics to identify fat-tail risks. Tools like Monte Carlo simulations, stress-testing software, and volatility indices can provide traders with insights into potential extreme events. These tools allow for more informed decision-making and proactive risk management.

Emerging Markets and Fat Tails

Fat tails are particularly prevalent in emerging markets due to their higher volatility and susceptibility to external shocks. Events like political instability, currency devaluations, or commodity price fluctuations often trigger extreme market movements, providing both risks and opportunities for traders.

Historical Patterns in Fat Tails

Examining historical data across decades reveals recurring patterns in fat-tailed events. For example, financial crises often follow periods of excessive leverage or speculative bubbles. Learning from these patterns can help traders anticipate potential tail events and prepare accordingly.

Practical Tips for Traders

- Use trailing stops to lock in profits during trends.

- Incorporate scenario analysis to test portfolio resilience.

- Invest in hedging instruments during low-volatility periods.

- Avoid overleveraging to reduce exposure during tail events.

- Utilize advanced analytics tools for proactive risk management.

Frequently Asked Questions (FAQs)

Q: Are fat tails predictable? A: While their occurrence can’t be predicted with certainty, historical data and volatility patterns provide clues.

Q: How do fat tails differ from outliers? A: Fat tails represent recurring extreme events, whereas outliers are isolated anomalies.

Q: Can technology amplify fat tails? A: Yes, high-frequency trading and algorithmic strategies can sometimes magnify extreme market movements.

Wrapping Up

Fat tails are an inherent part of financial markets. While they introduce significant risks, they also offer unique opportunities for informed traders. By understanding fat tails, implementing robust risk management strategies, and exploring ways to profit from these extreme events, traders can better navigate the complexities of the market.

Bookmap provides advanced order flow tools and indicators that some traders use to identify and respond to fat tails. Ready to explore these features? Try Bookmap for free today!

Twitter

Twitter

Facebook

Facebook