2025 Futures Market Predictions: The Contracts Traders Will Be Watching Closely

The futures market is like a time machine with a price tag. What you predict today could influence your profits tomorrow! As we look ahead to 2025, the futures market is becoming more complex. But at the same time, it offers traders new opportunities and challenges. Would you like to learn how?

In this article, we’ll explore the dominant futures contracts in 2025. We will study the key sectors mentioned below:

- Commodities

- Index futures

- Cryptocurrencies

- Agriculture

You’ll learn how factors like geopolitical events, inflation concerns, and regulatory changes are influencing the most traded futures contracts, such as crude oil, gold, corn, and even Bitcoin. We’ll also highlight futures trading trends like the rise of Micro contracts, the growing importance of altcoin futures, and increased volumes during critical market events. Let’s begin.

Futures Contracts Expected to Dominate in 2025

The 2025 futures market is going to be highly dynamic. Several contracts are expected to take center stage across the following categories:

- Commodities,

- Indices, and

- Cryptocurrencies.

During these times, most traders are focusing on dominant futures contracts in 2025. By doing so, they are trying to capitalize on shifting demand and geopolitical developments. To stay ahead, you must understand these key areas and educate yourself thoroughly about futures trading trends.

Let’s study the futures contracts expected to dominate in 2025 in detail:

Commodities Futures

- A) Energy futures

Energy futures (particularly WTI crude oil and natural gas futures) are projected to remain among the most traded futures contracts in 2025. This dominance is primarily due to several global factors, such as:

- Geopolitical instability,

and

- Fluctuating demand for oil and natural gas.

These trends in the futures trading market show a strong reliance on energy commodities for industrial and economic stability.

Example:

- Say there is an increasing global demand for liquefied natural gas (LNG).

- This demand is combined with OPEC+ production adjustments.

- Now, this positions natural gas futures as a key focal point for traders.

- Also, this aligns with broader futures trading trends where energy commodities serve as a hedge against economic uncertainty.

From a political standpoint, crude oil futures are expected to see heightened activity. This will happen as governments are expected to balance:

- Energy security,

and

- Transition to renewable energy sources.

Furthermore, U.S. policies that emphasize energy independence and OPEC+ decisions (regarding production quotas) could further change the 2025 futures market. Due to such policy-driven factors, you need to keep monitoring dominant futures contracts in 2025. Ideally, you should track both short-term gains and long-term strategic investments.

- B) Precious Metals (Gold, Silver)

Gold and silver futures are likely to remain some of the most traded futures contracts in 2025. That’s primarily because traders often turn to these precious metals as safe-haven assets during times of inflation and economic uncertainty. Check the graphic below:

For example, during recent periods of market volatility, there were notable spikes in trading volumes for gold futures.

Now, when we look ahead, futures market predictions for 2025 suggest that gold and silver futures will see sustained demand. This will happen as geopolitical tensions and economic pressures persist. Additionally, elevated geopolitical risks and increased military expenditures could amplify interest in these metals.

- C) Agricultural Futures (Corn, Soybeans, Wheat)

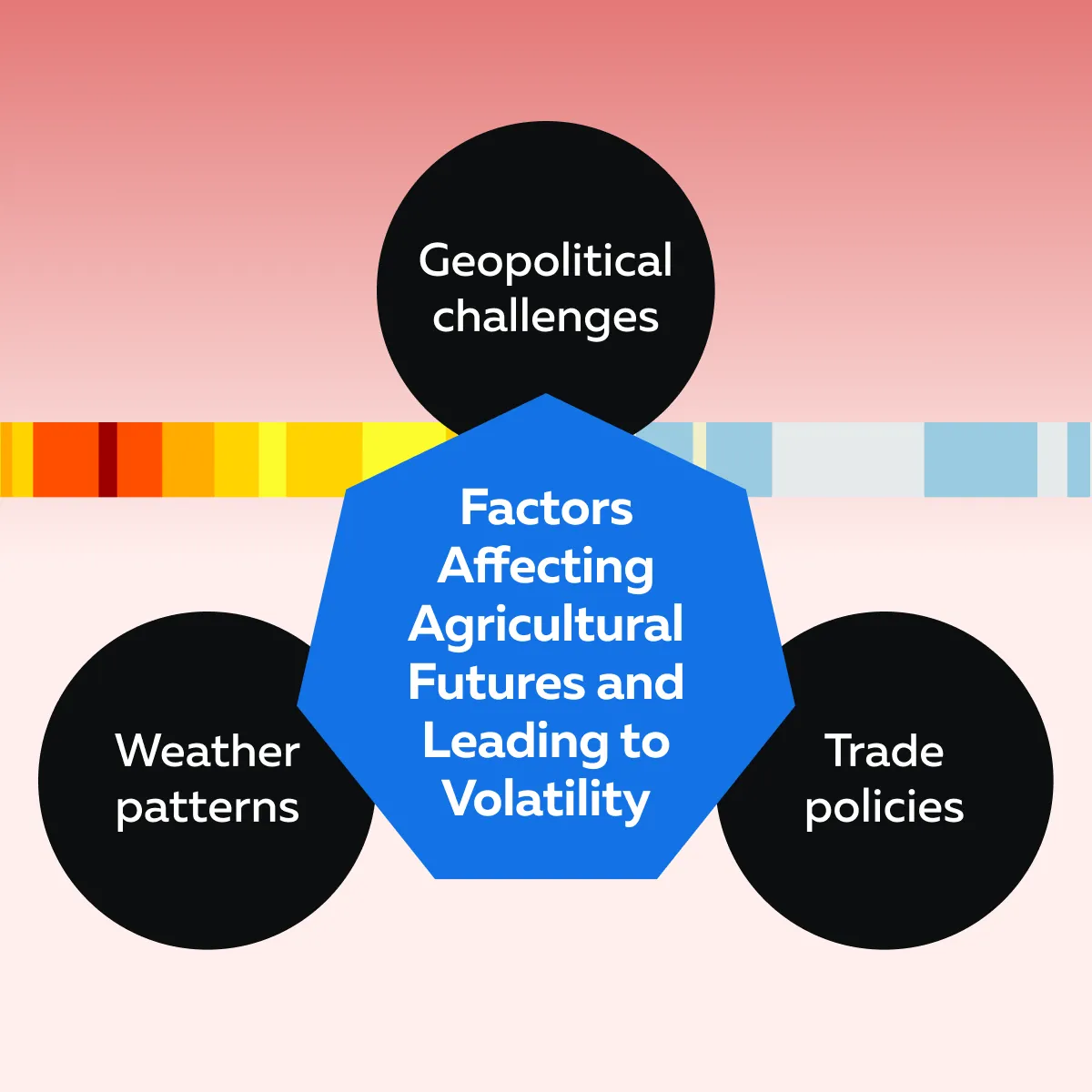

Agricultural futures (especially contracts for corn, soybeans, and wheat) also play a significant role in the 2025 futures market. Several factors heavily influence these contracts. Check the graphic below:

For example,

- U.S.-China trade relations are evolving.

- These are expected to impact the demand and pricing for corn and soybean futures.

- This event creates opportunities and risks for traders.

Additionally, government support for renewable fuels is also expected to drive interest in these agricultural commodities. Policies promoting biofuels are likely to heighten demand for corn and soybean futures. These dynamics emphasize the importance of agricultural contracts within the context of futures trading trends.

Index Futures

Index futures are projected to remain among the most traded futures contracts in 2025. For the unaware, these futures are based on underlying equity indices, such as the S&P 500 or NASDAQ-100. Index futures give investors the option to speculate on or hedge against movements in entire markets rather than individual stocks. Their efficiency and liquidity are key reasons for their dominance in the 2025 futures market.

One trend that is growing in popularity is Micro E-mini contracts. These are smaller-sized index futures. They have gained traction (particularly among retail traders) due to their low capital requirements. Micro E-mini futures allow you to participate in the market with less risk exposure.

Additionally, there is a growing interest in futures tied to emerging market indices. These indices offer unique opportunities for:

- Diversification,

and

- Profit.

That’s primarily because of the shifting global economic growth towards regions like Asia and Latin America. Moreover, futures linked to emerging markets are gaining attention as traders are anticipating higher returns from:

- Rapid industrialization,

- Urbanization,

and

- Demographic shifts in these areas.

Looking at futures market predictions, index futures tied to both established and emerging markets are expected to play an important role in portfolio strategies for 2025.

Crypto Futures

Gradually, crypto futures are emerging as a dominant segment in the 2025 futures market. That’s mainly due to:

- Growing institutional adoption of cryptos,

and

- Increasing recognition of crypto’s hedging potential.

These contracts are tied to digital assets like Bitcoin and Ethereum, allowing one to speculate on price movements. Please note that cryptocurrencies have now become more integrated into mainstream finance. They have solidified their position within futures trading trends.

Let’s see two major drivers of crypto futures growth:

| Regulatory Tailwinds | Expanding Beyond Bitcoin and Ethereum |

|

|

Stay ahead of futures market movements in 2025 with Bookmap’s order flow insights.

Volume Trends and What They Mean for Traders

It is expected that volume trends in the 2025 futures market will play a crucial role. They are expected to:

- Influence trading strategies,

and

- Identify emerging opportunities.

Please note that by analyzing trading volumes, you can better understand shifts in trader sentiment. This analysis helps you to position yourself smartly in response to changing dynamics. Let’s gain more clarity:

Increasing Adoption of Micro Contracts

One of the most notable futures trading trends is the growing popularity of Micro contracts. These smaller-sized contracts (including Micro E-mini and Micro commodity futures) have lowered the entry barrier for retail traders. With them, you can participate in futures markets with significantly less capital.

This democratization of access is important. It allows more individual traders to gain exposure to dominant futures contracts in 2025, such as index futures or energy futures.

Higher Volumes During Key Events

Certain events (such as climate disruptions or geopolitical crises) lead to spikes in the trading volumes of specific futures contracts.

Example:

- Agricultural futures (for corn and wheat) experience heightened activity during extreme weather.

- This happens due to their impact on crop yields and global supply chains.

- Similarly, energy futures (crude oil and natural gas) see significant volume increases during geopolitical conflicts or OPEC+ decisions.

Tracking Volume for Insights

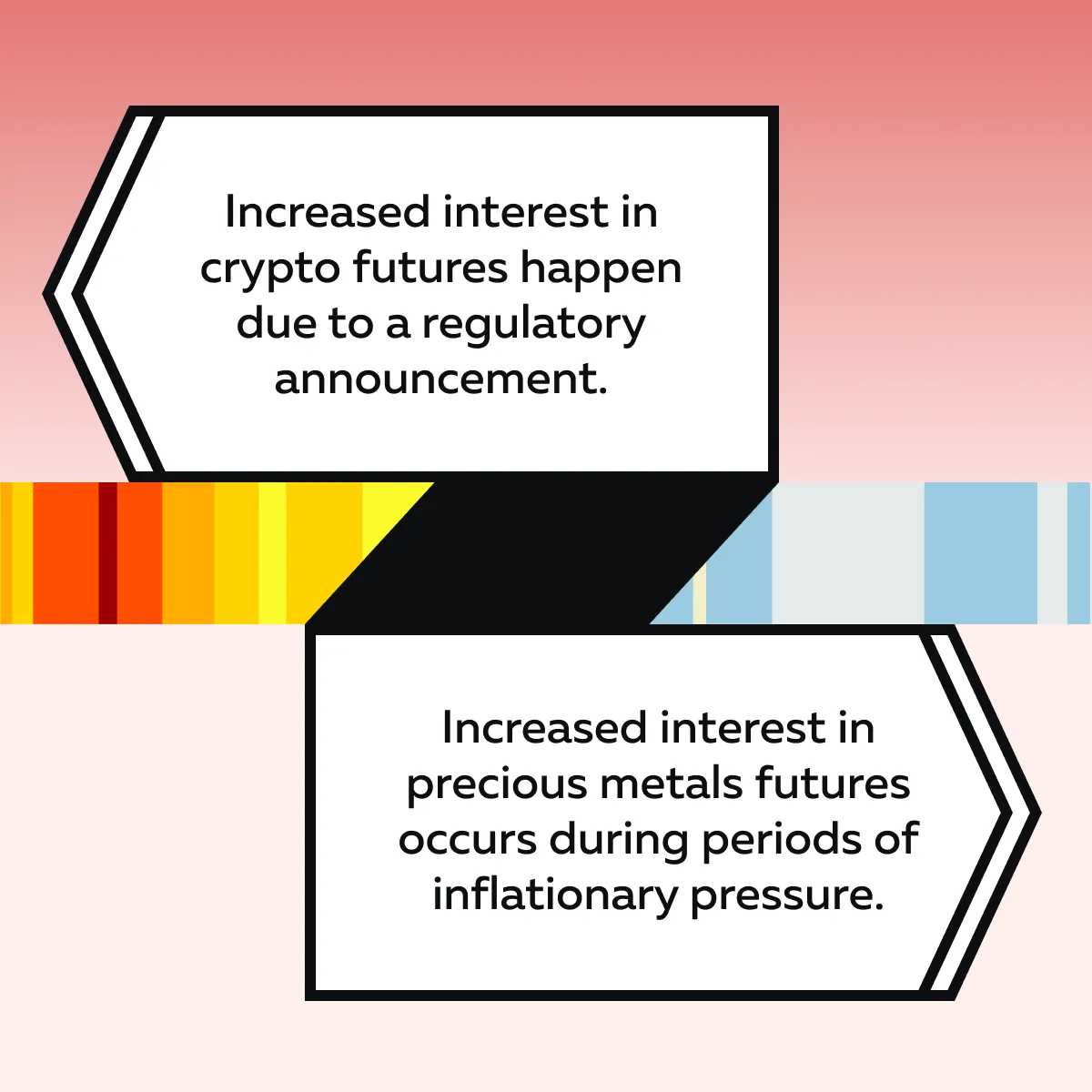

Be aware that volume spikes in most traded futures contracts act as indicators of market sentiment. A sudden surge in activity reflects increased interest in a particular sector. See the graphic below for examples:

To trade better, you must track these patterns. They reveal where institutional and retail interest is shifting.

Risks to Watch in 2025 Futures Trading

As traders deal with the 2025 futures market, it is necessary to understand the likely risks. This helps in mitigating losses and making informed decisions. Let’s have a look at some common risks you must look for in 2025:

1. Liquidity Challenges

One of the primary risks in the 2025 futures market is the likelihood of liquidity constraints. These constraints particularly occur in niche or emerging futures markets. Due to this risk, contracts tied to less-established assets (such as altcoins or new commodities) face challenges such as:

- Wider bid-ask spreads,

and

- Increased slippage during low-volume periods.

For example,

- Say traders are participating in altcoin futures markets, such as those for Solana or Cardano.

- They face difficulty in executing trades efficiently during quieter market sessions.

- These liquidity issues amplify trading costs and complicate strategies.

Therefore, you must carefully select dominant futures contracts in 2025. This allows you to assess market depth better and make a smart execution. Track liquidity and volume trends in leading futures contracts using Bookmap’s advanced heatmaps.

2. Volatility Risks

Volatility remains a double-edged sword in the 2025 futures market. It offers both opportunities and risks. Please note that geopolitical instability and unexpected economic data releases usually trigger sharp price swings. They catch traders unprepared.

For example,

- Say there are sudden announcements made from OPEC+.

- These announcements are about changes in oil production quotas.

- This leads to extreme volatility in crude oil futures.

In response to volatility risks, you must remain vigilant and employ robust risk management practices.

3. Regulatory Changes

New rules or tax policies significantly influence specific futures markets. This effect is particularly felt in high-growth areas like:

- Crypto futures,

or

- Sectors dependent on government subsidies.

Usually, these regulatory changes either enhance or disrupt trading dynamics. Check the graphic below for examples:

Conclusion

As we look ahead to the 2025 futures market, certain contracts are clearly positioned to dominate.

- Energy futures (like crude oil and natural gas) will remain important due to geopolitical and economic factors.

- Agricultural futures (for corn, wheat, and soybeans) will be heavily influenced by climate events and global trade policies.

- Gold and silver futures will continue to attract interest as safe-haven assets.

- Crypto futures will emerge due to institutional adoption, regulatory clarity, and the growth of decentralized finance.

- Index futures will remain among the most traded futures contracts due to their ability to provide market exposure with minimal capital through tools like Micro contracts.

To achieve success, you must stay informed about these futures trading trends. Also, manage the several risks they carry, such as liquidity challenges, volatility, and regulatory changes. Ideally, you should adopt flexible strategies and anticipate shifts in sentiment.

Furthermore, to gain a competitive advantage, start using our advanced market analysis tool, Bookmap. Using it, you can visualize market dynamics in real time and better deal with dominant futures contracts in 2025. Gain a competitive edge with Bookmap’s real-time futures market analysis tools.

FAQ

Which futures contracts are expected to dominate the market in 2025?

Energy futures like WTI crude oil and natural gas are projected to remain dominant due to geopolitical factors and shifting demand. Precious metals (gold and silver), agricultural futures (corn, soybeans, wheat), index futures, and crypto futures tied to assets like Bitcoin and Ethereum are also expected to see high trading volumes and strong trader interest.

Why are Micro futures contracts gaining popularity among traders?

Micro futures contracts lower the entry barrier for traders by requiring less capital, allowing broader participation in futures markets. They offer exposure to major indices and commodities while enabling better risk management for smaller accounts, aligning with the trend toward more accessible trading options in 2025.

What risks should traders watch for in the 2025 futures market?

Traders should be cautious of liquidity challenges in less-established markets, heightened volatility from geopolitical or economic events, and regulatory changes impacting sectors like crypto and commodities. Staying adaptable and monitoring real-time order flow and volume trends can help manage these risks effectively.

Twitter

Twitter

Facebook

Facebook