How Cumulative Volume Delta Can Transform Your Trading Strategy

In today’s trading world, the right tools can be the difference between success and missed opportunities. Among the various tools traders use, the Cumulative Volume Delta (CVD) is gaining attention for its valuable insights.

This essential element of order flow analysis has the power to transform trading strategies, offering a deeper understanding of market dynamics. Join us as we explore the impact of CVD on refining and elevating trading decisions.

What is Cumulative Volume Delta (CVD)?

Cumulative Volume Delta (CVD) is a metric used in trading to analyze market dynamics by tracking the net difference between buying and selling volumes over a specific timeframe.

It offers traders a window into the prevailing buying or selling pressure, revealing insights into price movement dynamics influenced by supply and demand shifts.

Calculating CVD: Step-By-Step

CVD is calculated by accumulating the volume traded on the “bid” (selling) side and subtracting the volume traded on the “ask” (buying) side, or vice versa—depending on the specific market you’re examining.

Now, let’s take a closer look at the step-by-step process of calculating CVD using a scenario from a fictional market:

Consider this scenario: You are a day trader specializing in e-mini S&P 500 futures. You’ve been monitoring the market and noticed that the market has been trading in a tight range around a key resistance level. You’re looking for signs of a potential breakout or reversal. With that in mind, you’ve decided to calculate and analyze CVD.

Guide:

Steps | Explanation | Indication |

1. Gathering Data | You start by collecting price and volume data for the e-mini S&P 500 futures over the past few days.

| |

2. Calculating Cumulative Volume Delta | You calculate the Cumulative Volume Delta (CVD) by:

Subtracting the volume traded on the “ask” (buying) side from the volume traded on the “bid” (selling) side for each price tick. | You get a running total of the net buying or selling pressure.

|

3. Analyzing CVD Patterns | You plot the CVD values on a chart alongside the price movement. | You notice that the CVD has been consistently negative as the market approaches the key resistance level, indicating a higher selling volume.

|

4. Divergence and Reversal Signal | You observe that despite the negative CVD and the selling pressure, the price has failed to break below a certain support level. | This divergence between the negative CVD and the lack of downward price movement signals that sellers are losing momentum.

|

5. Positive CVD Spike | During the trading session, you see a sudden positive spike in CVD as the market attempts to breach the resistance level. | This indicates that buyers are aggressively entering the market at that level.

|

6. Confirming with Volume | You check the volume accompanying the positive CVD spike and find that it’s significantly higher than the average volume. | This confirms strong buying interest.

|

7. Acting | You decide to initiate a long position (buy) just above the resistance level.

| Based on the positive CVD spike, volume confirmation, and the lack of downward price movement despite negative CVD, you interpret that the market sentiment is shifting. |

8. Risk Management | To manage risk, you set a stop-loss order just below the recent support level. | This ensures that if the market reverses unexpectedly, your potential losses are limited. |

9. Monitoring the Trade | As the market progresses, you notice that the price continues to move higher, and the CVD remains positive. | This confirms your decision to stay in the trade.

|

10. Exit Strategy | You establish an exit strategy based on your profit target or a specific technical level. | When the price reaches your target, you exit the trade, locking in your profits.

|

It could be understood from this example that Cumulative Volume Delta (CVD) played a pivotal role in providing insights into the market’s order flow and sentiment.

This tool facilitated the identification of shifts in market aggression, ultimately bolstering the trader’s confidence needed to execute a trading decision. Importantly, it is not merely a standalone signal but rather a confluence of events that collectively contribute to interpreting key aspects of the market, including:

Market trends

Potential reversals

Shifts in sentiments

The Significance of CVD in Trading

Cumulative Volume Delta (CVD) offers traders nuanced insights beyond what traditional price charts provide. Here’s a breakdown of how traders incorporate CVD to enhance their decision-making:

1. Identifying Aggressive Buyers and Sellers:

Traders use CVD to identify which side of the market is more aggressive.

If the CVD is positive, it suggests that buyers are more aggressive, possibly indicating upward price momentum.

Conversely, a negative CVD implies that sellers are dominating, potentially signaling a downward price movement.

By understanding the aggressor’s side, traders can adjust their strategies accordingly.

2. Confirming Reversals and Breakouts:

CVD can be used to confirm potential trend reversals or breakout points.

For example,

If prices are making higher highs while CVD is making lower highs, it could indicate that the buying pressure is weakening, and a reversal might be imminent.

- This insight aids traders in avoiding traps like false breakouts.

3. Support and Resistance Validation:

- Analyzing CVD when the price nears key support or resistance can gauge the strength of these levels.

For instance, if the price is approaching a resistance level and CVD shows increased selling pressure, it indicates a price reversal from that level.

4. Divergence Analysis:

A bullish divergence occurs when the price makes lower lows while CVD makes higher lows, indicating potential buying interest.

Conversely, a bearish divergence occurs when the price makes higher highs while CVD makes lower highs, suggesting a possible reversal.

5. Volume Confirmation:

CVD can also confirm the significance of price movements by considering volume alongside price action.

For example, a price move accompanied by a positive CVD and high volume suggests strong buying interest, enhancing the likelihood of a sustainable trend.

6. Intraday Trading Strategies:

Intraday traders can use CVD to make their day-to-day trading decisions.

For example, if CVD starts to spike positively and the price is also moving up, it could indicate a surge of buying interest, potentially supporting a scalping or day trading strategy.

How Bookmap’s CVD Indicator Enhances Trading Strategies

The Cumulative Volume Delta (CVD) indicator is a powerful tool included Bookmap that offers traders insights into market liquidity and order flow dynamics.

By visualizing the net buying and selling pressure at different price levels, CVD assists traders in understanding market momentum and making informed trading decisions.

Using Bookmap’s CVD Indicator

Accessing the CVD Indicator:

To access the CVD indicator, open Bookmap and click on the “Studies Configuration Tool.”

From the list, select “Cumulative Volume Delta.”

Open the sub-chart by clicking on the arrow located at the bottom of the price ladder.

Configuring the CVD Indicator:

To customize the appearance and settings of the CVD indicator, click on the widget configuration icon.

In both the sub-chart and the widget panel, ensure that “CVD” is selected.

Understanding CVD Calculation:

CVD calculates the difference between market buy orders (considered as positive values) and market sell orders (considered as negative values).

This calculation is plotted over time in the sub-chart and updated in real time in the widget panel.

The resulting values offer valuable insights into market momentum and the behaviors of buyers and sellers.

Incorporating CVD into Decision-Making

CVD’s ability to visualize market liquidity, momentum, and order flow dynamics allows traders to navigate the markets more effectively, ultimately enhancing their trading strategies and outcomes. This is how traders incorporate the different elements of CVD into their decision-making:

Price Chart: Bookmap displays the price chart of the asset, showing the price movement over time.

Heatmap: A heatmap overlays the price chart, visually representing the CVD values at different price levels. The heatmap color intensity indicates the magnitude of the CVD at each price level.

Cumulative Delta Bars: Vertical bars alongside the price chart represent the cumulative delta values. Positive bars indicate net buying pressure, while negative bars indicate net selling pressure.

Volume Histogram: Below the price chart, a histogram shows the volume traded at each price level, allowing traders to correlate volume with CVD.

Interpreting and Applying the Visualization

Bookmap’s CVD visualization empowers traders to go beyond traditional price charts and understand the dynamics of order flow, which drives price movements. Most traders interpret and apply the insights gained from heatmaps, histograms, price charts, and delta bars in the following manner:

Analysis | Explanation | Practical Application |

Identifying Key Levels | You can identify key support and resistance levels by observing where the CVD values are concentrated. | High CVD values at a specific level indicate significant buying or selling interest. |

Aggression Analysis | By looking at the cumulative delta bars, you can gauge the intensity of buying or selling aggression. | Rapidly increasing positive bars may signal strong buying interest, while sharp negative bars indicate strong selling interest. |

Divergence Detection | You can detect divergences between price and CVD. | If the price is making higher highs but the cumulative delta bars are not rising proportionally, it might suggest a potential reversal or weakening trend. |

Confirmation with Volume | Comparing the volume histogram with the CVD heatmap can validate buying or selling pressure. | High volume accompanied by intense CVD can confirm the strength of a price movement.

|

Order Flow Analysis | Analyzing how the heatmap changes over time allows you to understand how market participants are interacting with the order book. | Sudden shifts in CVD intensity might signal shifts in market sentiment. |

Intraday Decision-Making | Active traders can rely on real-time CVD data for instantaneous decisions. | If you see a sudden surge in positive CVD alongside increasing volume, it might indicate a potential breakout opportunity. |

How Cumulative Volume Delta Offers Additional Insights for Traders

Cumulative Volume Delta (CVD) provides traders with a deeper insight into the inner workings of market dynamics. It allows them to meticulously dissect the interplay between buying and selling forces, presenting a lens through which market sentiments, order flows, and potential trend shifts can be analyzed.

Far from the limits of conventional price chart analyses, CVD offers traders an unparalleled perspective into the market’s pulse.

Leveraging CVD Insights for Success in Trading Competitions

For participants in trading competitions, where precision and speed are of the essence, leveraging CVD insights can provide a significant competitive advantage.

Let’s consider the example of Blue Jacket’s crypto segment:

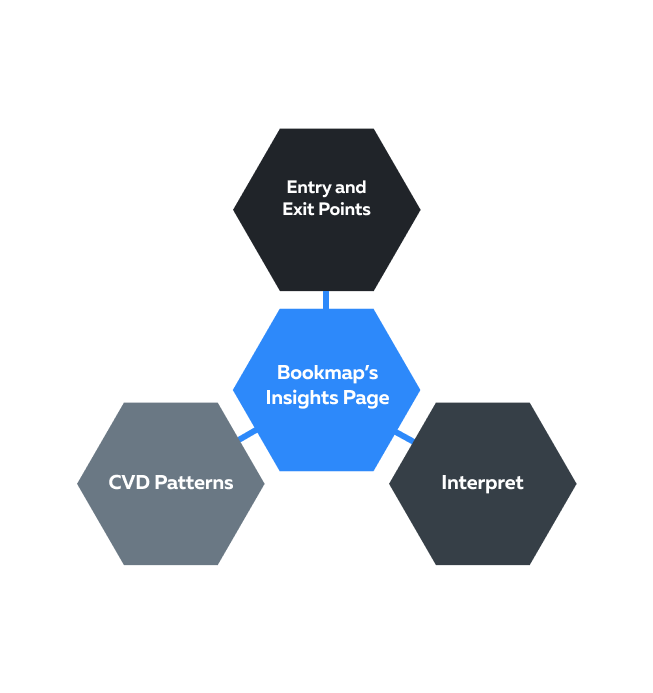

Picture yourself participating in a trading competition, particularly in Blue Jacket’s crypto segment. As you seek an edge, you turn to Bookmap’s Insights page and filter results using the ‘CVD’ tag. Your screen now displays an in-depth analysis of CVD patterns for a trending cryptocurrency, revealing:

CVD Patterns: Visual representations of CVD patterns over various time frames.

Interpretation: Insights into how CVD patterns correlate with price movements and market trends.

Entry and Exit Points: Notable trading opportunities were identified using CVD analysis.

How Do You Gain A Competitive Advantage?

By exploring these CVD insights, you gain a deeper understanding of how the cryptocurrency market behaves. This, in turn, enables you to identify potential trading opportunities that others might have overlooked.

Your adeptness in reacting to real-time market shifts, based on real-time CVD data, gives you an edge in executing well-timed trades and maximizing your gains during the trading competition.

Ready to put your knowledge of Cumulative Volume Delta into action and test your trading strategies? Join Bookmap’s Blue Jacket competition for a chance to compete and potentially win three months of free access to Bookmap’s Global+ package.

This premium package offers advanced features like CVD, enhanced market visualization, and a plethora of educational resources. Don’t miss out on this exciting opportunity! Join the Blue Jacket Competition now.

CVD Conclusion

Cumulative Volume Delta (CVD) offers traders a deeper look into market dynamics, acting as a confluence indicator that melds buying and selling forces. Rather than just showing price moves, CVD gives insights into the ‘why’ behind those moves.

Bookmap’s tools further simplify CVD, making it easier to spot key market moments and adjust strategies. For traders aiming for consistency and an edge, understanding and mastering CVD is essential.

Ready to tackle the markets with in-depth insights? Sign up to Bookmap for FREE now and level up your trading.

In today’s trading world, the right tools can be the difference between success and missed opportunities. Among the various tools traders use, the Cumulative Volume Delta (CVD) is gaining attention for its valuable insights.

This essential element of order flow analysis has the power to transform trading strategies, offering a deeper understanding of market dynamics. Join us as we explore the impact of CVD on refining and elevating trading decisions.

What is Cumulative Volume Delta (CVD)?

Cumulative Volume Delta (CVD) is a metric used in trading to analyze market dynamics by tracking the net difference between buying and selling volumes over a specific timeframe.

It offers traders a window into the prevailing buying or selling pressure, revealing insights into price movement dynamics influenced by supply and demand shifts.

Calculating CVD: Step-By-Step

CVD is calculated by accumulating the volume traded on the “bid” (selling) side and subtracting the volume traded on the “ask” (buying) side, or vice versa—depending on the specific market you’re examining.

Now, let’s take a closer look at the step-by-step process of calculating CVD using a scenario from a fictional market:

Consider this scenario: You are a day trader specializing in e-mini S&P 500 futures. You’ve been monitoring the market and noticed that the market has been trading in a tight range around a key resistance level. You’re looking for signs of a potential breakout or reversal. With that in mind, you’ve decided to calculate and analyze CVD.

Guide:

Steps | Explanation | Indication |

1. Gathering Data | You start by collecting price and volume data for the e-mini S&P 500 futures over the past few days.

| |

2. Calculating Cumulative Volume Delta | You calculate the Cumulative Volume Delta (CVD) by:

Subtracting the volume traded on the “ask” (buying) side from the volume traded on the “bid” (selling) side for each price tick. | You get a running total of the net buying or selling pressure.

|

3. Analyzing CVD Patterns | You plot the CVD values on a chart alongside the price movement. | You notice that the CVD has been consistently negative as the market approaches the key resistance level, indicating a higher selling volume.

|

4. Divergence and Reversal Signal | You observe that despite the negative CVD and the selling pressure, the price has failed to break below a certain support level. | This divergence between the negative CVD and the lack of downward price movement signals that sellers are losing momentum.

|

5. Positive CVD Spike | During the trading session, you see a sudden positive spike in CVD as the market attempts to breach the resistance level. | This indicates that buyers are aggressively entering the market at that level.

|

6. Confirming with Volume | You check the volume accompanying the positive CVD spike and find that it’s significantly higher than the average volume. | This confirms strong buying interest.

|

7. Acting | You decide to initiate a long position (buy) just above the resistance level.

| Based on the positive CVD spike, volume confirmation, and the lack of downward price movement despite negative CVD, you interpret that the market sentiment is shifting. |

8. Risk Management | To manage risk, you set a stop-loss order just below the recent support level. | This ensures that if the market reverses unexpectedly, your potential losses are limited. |

9. Monitoring the Trade | As the market progresses, you notice that the price continues to move higher, and the CVD remains positive. | This confirms your decision to stay in the trade.

|

10. Exit Strategy | You establish an exit strategy based on your profit target or a specific technical level. | When the price reaches your target, you exit the trade, locking in your profits.

|

It could be understood from this example that Cumulative Volume Delta (CVD) played a pivotal role in providing insights into the market’s order flow and sentiment.

This tool facilitated the identification of shifts in market aggression, ultimately bolstering the trader’s confidence needed to execute a trading decision. Importantly, it is not merely a standalone signal but rather a confluence of events that collectively contribute to interpreting key aspects of the market, including:

Market trends

Potential reversals

Shifts in sentiments

The Significance of CVD in Trading

Cumulative Volume Delta (CVD) offers traders nuanced insights beyond what traditional price charts provide. Here’s a breakdown of how traders incorporate CVD to enhance their decision-making:

1. Identifying Aggressive Buyers and Sellers:

Traders use CVD to identify which side of the market is more aggressive.

If the CVD is positive, it suggests that buyers are more aggressive, possibly indicating upward price momentum.

Conversely, a negative CVD implies that sellers are dominating, potentially signaling a downward price movement.

By understanding the aggressor’s side, traders can adjust their strategies accordingly.

2. Confirming Reversals and Breakouts:

CVD can be used to confirm potential trend reversals or breakout points.

For example,

If prices are making higher highs while CVD is making lower highs, it could indicate that the buying pressure is weakening, and a reversal might be imminent.

- This insight aids traders in avoiding traps like false breakouts.

3. Support and Resistance Validation:

- Analyzing CVD when the price nears key support or resistance can gauge the strength of these levels.

For instance, if the price is approaching a resistance level and CVD shows increased selling pressure, it indicates a price reversal from that level.

4. Divergence Analysis:

A bullish divergence occurs when the price makes lower lows while CVD makes higher lows, indicating potential buying interest.

Conversely, a bearish divergence occurs when the price makes higher highs while CVD makes lower highs, suggesting a possible reversal.

5. Volume Confirmation:

CVD can also confirm the significance of price movements by considering volume alongside price action.

For example, a price move accompanied by a positive CVD and high volume suggests strong buying interest, enhancing the likelihood of a sustainable trend.

6. Intraday Trading Strategies:

Intraday traders can use CVD to make their day-to-day trading decisions.

For example, if CVD starts to spike positively and the price is also moving up, it could indicate a surge of buying interest, potentially supporting a scalping or day trading strategy.

How Bookmap’s CVD Indicator Enhances Trading Strategies

The Cumulative Volume Delta (CVD) indicator is a powerful tool included Bookmap that offers traders insights into market liquidity and order flow dynamics.

By visualizing the net buying and selling pressure at different price levels, CVD assists traders in understanding market momentum and making informed trading decisions.

Using Bookmap’s CVD Indicator

Accessing the CVD Indicator:

To access the CVD indicator, open Bookmap and click on the “Studies Configuration Tool.”

From the list, select “Cumulative Volume Delta.”

Open the sub-chart by clicking on the arrow located at the bottom of the price ladder.

Configuring the CVD Indicator:

To customize the appearance and settings of the CVD indicator, click on the widget configuration icon.

In both the sub-chart and the widget panel, ensure that “CVD” is selected.

Understanding CVD Calculation:

CVD calculates the difference between market buy orders (considered as positive values) and market sell orders (considered as negative values).

This calculation is plotted over time in the sub-chart and updated in real time in the widget panel.

The resulting values offer valuable insights into market momentum and the behaviors of buyers and sellers.

Incorporating CVD into Decision-Making

CVD’s ability to visualize market liquidity, momentum, and order flow dynamics allows traders to navigate the markets more effectively, ultimately enhancing their trading strategies and outcomes. This is how traders incorporate the different elements of CVD into their decision-making:

Price Chart: Bookmap displays the price chart of the asset, showing the price movement over time.

Heatmap: A heatmap overlays the price chart, visually representing the CVD values at different price levels. The heatmap color intensity indicates the magnitude of the CVD at each price level.

Cumulative Delta Bars: Vertical bars alongside the price chart represent the cumulative delta values. Positive bars indicate net buying pressure, while negative bars indicate net selling pressure.

Volume Histogram: Below the price chart, a histogram shows the volume traded at each price level, allowing traders to correlate volume with CVD.

Interpreting and Applying the Visualization

Bookmap’s CVD visualization empowers traders to go beyond traditional price charts and understand the dynamics of order flow, which drives price movements. Most traders interpret and apply the insights gained from heatmaps, histograms, price charts, and delta bars in the following manner:

Analysis | Explanation | Practical Application |

Identifying Key Levels | You can identify key support and resistance levels by observing where the CVD values are concentrated. | High CVD values at a specific level indicate significant buying or selling interest. |

Aggression Analysis | By looking at the cumulative delta bars, you can gauge the intensity of buying or selling aggression. | Rapidly increasing positive bars may signal strong buying interest, while sharp negative bars indicate strong selling interest. |

Divergence Detection | You can detect divergences between price and CVD. | If the price is making higher highs but the cumulative delta bars are not rising proportionally, it might suggest a potential reversal or weakening trend. |

Confirmation with Volume | Comparing the volume histogram with the CVD heatmap can validate buying or selling pressure. | High volume accompanied by intense CVD can confirm the strength of a price movement.

|

Order Flow Analysis | Analyzing how the heatmap changes over time allows you to understand how market participants are interacting with the order book. | Sudden shifts in CVD intensity might signal shifts in market sentiment. |

Intraday Decision-Making | Active traders can rely on real-time CVD data for instantaneous decisions. | If you see a sudden surge in positive CVD alongside increasing volume, it might indicate a potential breakout opportunity. |

How Cumulative Volume Delta Offers Additional Insights for Traders

Cumulative Volume Delta (CVD) provides traders with a deeper insight into the inner workings of market dynamics. It allows them to meticulously dissect the interplay between buying and selling forces, presenting a lens through which market sentiments, order flows, and potential trend shifts can be analyzed.

Far from the limits of conventional price chart analyses, CVD offers traders an unparalleled perspective into the market’s pulse.

Leveraging CVD Insights for Success in Trading Competitions

For participants in trading competitions, where precision and speed are of the essence, leveraging CVD insights can provide a significant competitive advantage.

Let’s consider the example of Blue Jacket’s crypto segment:

Picture yourself participating in a trading competition, particularly in Blue Jacket’s crypto segment. As you seek an edge, you turn to Bookmap’s Insights page and filter results using the ‘CVD’ tag. Your screen now displays an in-depth analysis of CVD patterns for a trending cryptocurrency, revealing:

CVD Patterns: Visual representations of CVD patterns over various time frames.

Interpretation: Insights into how CVD patterns correlate with price movements and market trends.

Entry and Exit Points: Notable trading opportunities were identified using CVD analysis.

How Do You Gain A Competitive Advantage?

By exploring these CVD insights, you gain a deeper understanding of how the cryptocurrency market behaves. This, in turn, enables you to identify potential trading opportunities that others might have overlooked.

Your adeptness in reacting to real-time market shifts, based on real-time CVD data, gives you an edge in executing well-timed trades and maximizing your gains during the trading competition.

Ready to put your knowledge of Cumulative Volume Delta into action and test your trading strategies? Join Bookmap’s Blue Jacket competition for a chance to compete and potentially win three months of free access to Bookmap’s Global+ package.

This premium package offers advanced features like CVD, enhanced market visualization, and a plethora of educational resources. Don’t miss out on this exciting opportunity! Join the Blue Jacket Competition now.

CVD Conclusion

Cumulative Volume Delta (CVD) offers traders a deeper look into market dynamics, acting as a confluence indicator that melds buying and selling forces. Rather than just showing price moves, CVD gives insights into the ‘why’ behind those moves.

Bookmap’s tools further simplify CVD, making it easier to spot key market moments and adjust strategies. For traders aiming for consistency and an edge, understanding and mastering CVD is essential.

Ready to tackle the markets with in-depth insights? Sign up to Bookmap for FREE now and level up your trading.

Twitter

Twitter

Facebook

Facebook