How Order Flow Imbalance Can Boost Your Trading Success

Financial markets are far from being perfect. When participation from many market participants with varied interests is involved, mismatches are bound to happen! One such key mismatch is the “order book imbalance,” which shows the difference between buy and sell orders at different price levels in the order book. Often, it is regarded as a crucial indicator for predicting market sentiment and potential price movements.

Through this article, we will explore how to identify and analyze order flow imbalance using advanced market analysis tools like Bookmap. Also, we will learn practical trading strategies — scalping, day trading, and swing trading — and check how traders can use order flow imbalance to make informed decisions.

Moreover, we will cover advanced techniques like volume profile analysis and heatmap visualization and understand how they offer deeper insights into market behavior. Let’s get started.

What is Order Flow Imbalance?

Order flow imbalance is the difference between the volume of buy orders and sell orders at different price levels in the order book. You can think of an order book as a dynamic list. It displays buy and sell orders for a specific asset, usually organized by price levels. For a more detailed explanation, you can refer to Bookmap’s learning center.

Why is Order Flow Imbalance Important?

It is essential to state that order flow imbalance is a crucial indicator for understanding:

and

- Potential price movements.

Let’s see how:

| Market Sentiment | Potential Price Movements |

|

|

Now, to gain a better understanding, let’s study an example involving a stock trading at $100.

A trader, upon checking their order book, finds that there are:

- 500 buy orders at $100.50,

- 200 buy orders at $100.00,

- 1000 sell orders at $101.00, and

- 300 sell orders at $101.50.

In this scenario, there is a notable imbalance at the $100.50 price level, with significantly more buy orders compared to sell orders. This indicates that buyers are willing to purchase the stock at a slightly higher price, which creates upward pressure. If this buying interest continues, the stock price might move upward to meet the sell orders at $101.00.

What is Spoofing? How Does it Impact Order Flow Imbalance?

Spoofing is a manipulative practice. It involves a trader placing large orders on one side of the order book without intending to execute them. These fictitious orders:

- Create an artificial imbalance

and

- Mislead other traders about the true market sentiment and potential price movements.

For example,

- Say Mr. A placed a large buy order to create the illusion of a strong buying interest.

- This influences other traders, and they enter buy positions.

- Then, Mr. A cancels the order once the price starts moving upward.

Thus, traders must accurately identify spoofing as it is crucial for an accurate interpretation of order flow imbalance. To do so, traders should look for patterns such as sudden large orders that appear and disappear quickly. When traders are able to recognize these patterns, they can avoid potential traps set by market manipulators.

How to Identify Order Flow Imbalance

Identifying order flow imbalance requires specialized tools and platforms. Usually, these tools provide detailed and real-time data related to market orders. Most traders commonly use platforms like Bookmap to:

- Analyze the Depth of Market (DOM)

and

- Spot imbalances.

How to Use Bookmap to Visualize Order Flow Imbalance

Bookmap is an advanced market analysis tool. It provides real-time visualization of the order book by displaying liquidity and order flow in a heatmap format. This visualization allows traders to see where buy and sell orders are concentrated.

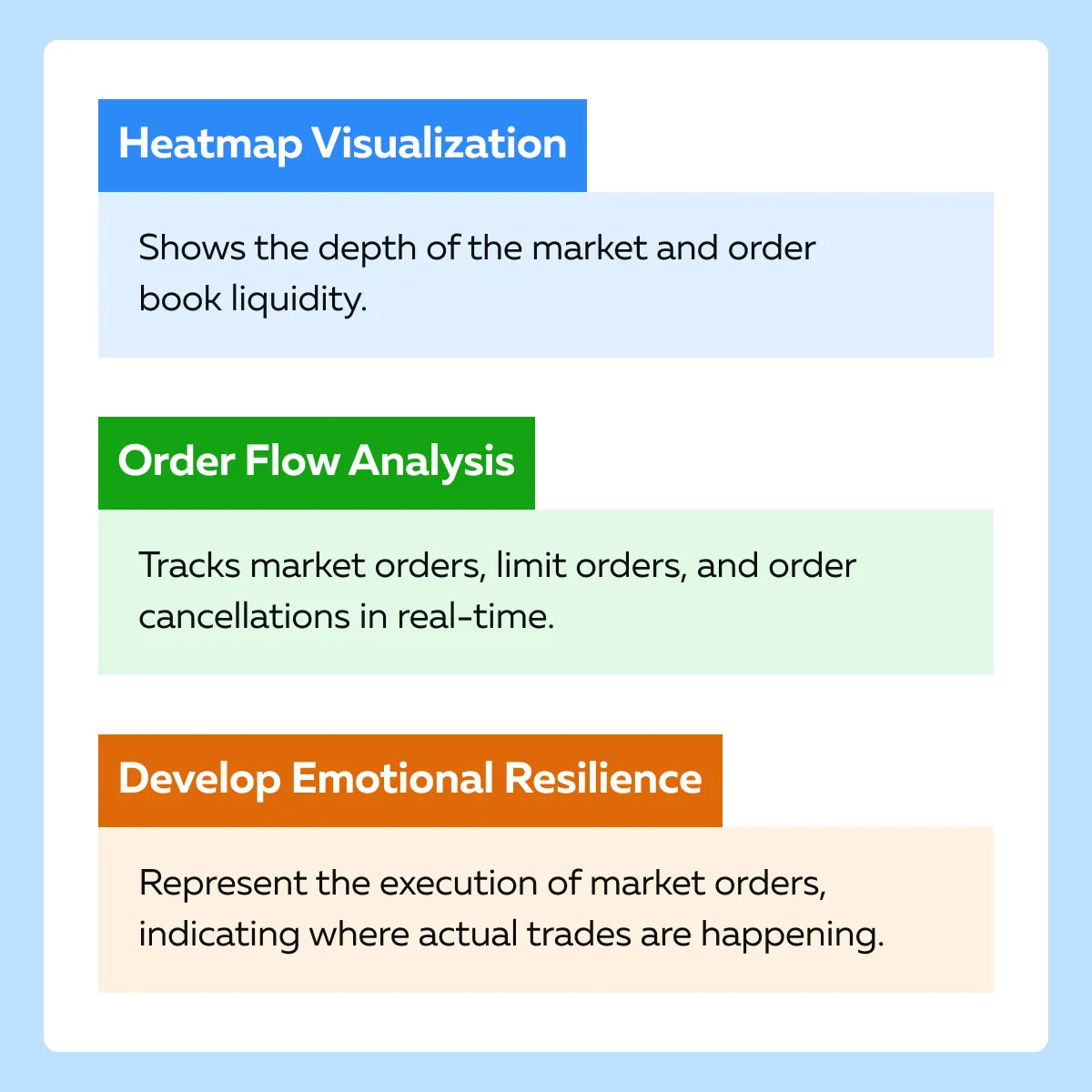

Some fey features are:

To gain an in-depth understanding of the various features of Bookmap, please refer to our exclusive knowledge base here.

Now, let’s learn in simple steps how you can use Bookmap to identify order flow imbalances:

- Set Up Bookmap

- Load the asset you want to analyze on Bookmap.

- The platform will display the order book as a heatmap.

- Analyze the Heatmap

- Look for areas with high concentrations of:

- Buy orders (green)

- Look for areas with high concentrations of:

and

- Sell orders (red).

- These areas indicate potential support and resistance levels.

- Monitor Volume Dots

- Pay attention to the volume dots.

- These dots represent market orders.

- Large clusters of buy or sell orders can indicate strong buying or selling pressure.

- Track Order Book Changes

- Observe how the order book evolves in real time.

- Sudden increases or decreases in orders signal potential price movements.

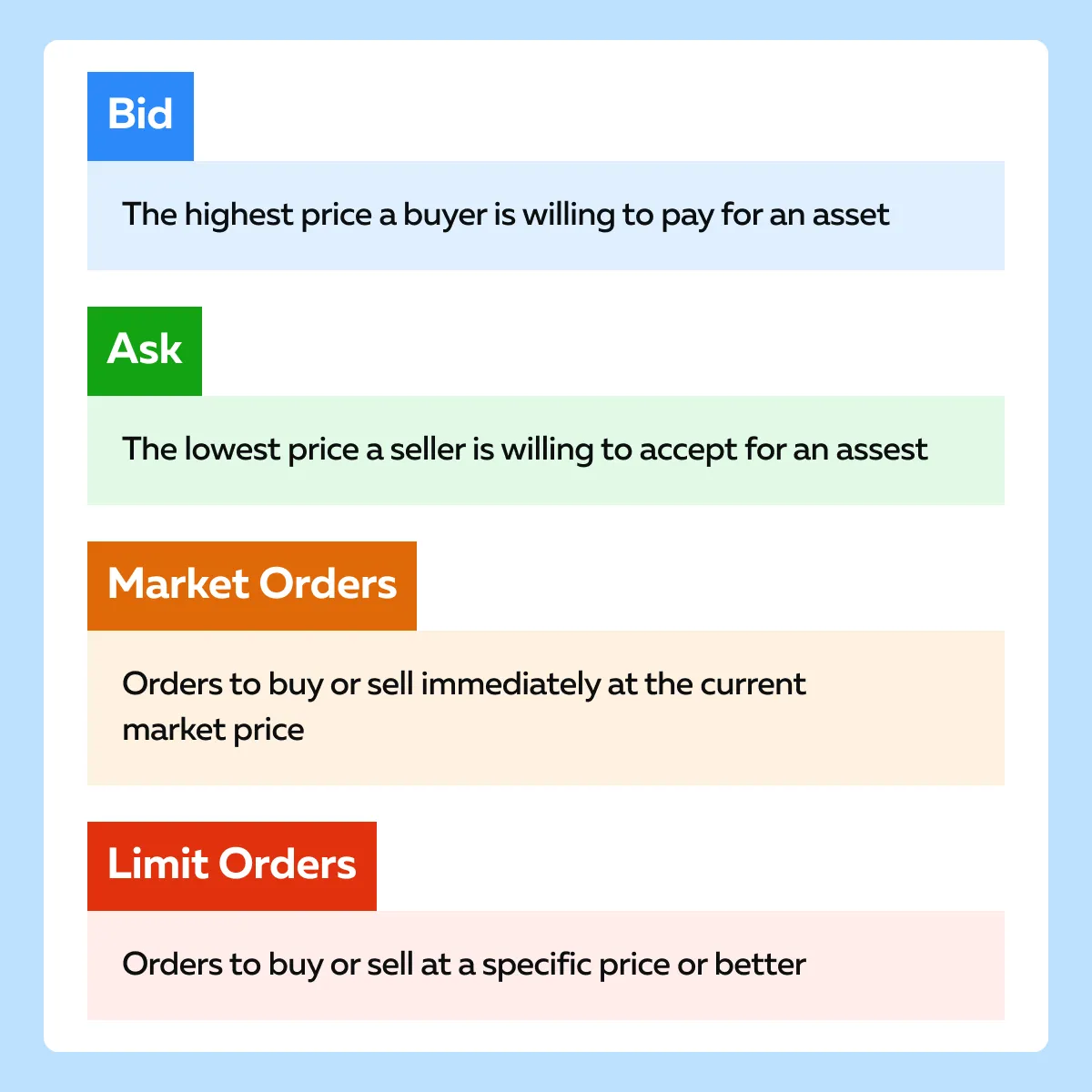

How to Read and Decode the Order Book

To effectively spot order flow imbalances, it’s crucial to understand the order book and its key terms. See the graphic below:

Now, let’s walk through an example of reading the order book through simple steps:

- Step I: Open the Order Book

- Access the order book through your trading platform or using advanced market analysis tools like Bookmap.

- Step II: Identify Key Levels

- Look for price levels with large volumes of buy and sell orders.

- For example:

- Buy Side:

- 1000 shares at $145.00 (bid)

- 500 shares at $144.50 (bid)

- Sell Side:

- 1500 shares at $146.00 (ask)

- 800 shares at $146.50 (ask)

- Buy Side:

- Step III: Spot Imbalances

- Compare the volumes on both sides.

- The presence of significantly more buy orders at $145.00 compared to sell orders at $146.00 indicates a potential upward pressure.

- Step IV: Monitor Changes

- Watch how these levels change over time.

- If the buy orders at $145.00 increase while sell orders at $146.00 decrease, it reinforces the likelihood of a price increase.

Now, let’s see how a significant imbalance appears on the order book:

| Bids | Asks |

| 2000 shares at $145.00 | 1000 shares at $145.50 |

| 1500 shares at $144.75 | 800 shares at $146.00 |

Here, we can see that there is a significant buy-side imbalance at $145.00 compared to the sell-side at $145.50. This situation suggests:

- Strong buying interest at $145.00

and

- Upward pressure on the stock price.

Analyzing Order Flow Imbalance for Trading Decisions

It must be noted that order flow imbalance is a powerful tool for traders. Most traders enhance their trading strategies by analyzing the difference between buy and sell orders at various price levels.

It helps to:

- Gauge market sentiment

and

- Identify optimal entry and exit points.

Let’s study this in detail.

How to Gauge Market Sentiment?

Traders must remember that when there is a high number of buy orders compared to sell orders, it signals a bullish sentiment. Conversely, a high number of sell orders compared to buy orders indicates a bearish sentiment.

Also, when the market shows a large imbalance with more buy orders than sell orders, it suggests that:

- Buyers are more aggressive

and

- They are pushing the price higher.

Usually, this is an early indicator of a potential price rally. Let’s read a hypothetical example focusing specifically on how a strong buy-side imbalance precedes a price rally:

- Say a stock is currently trading at $50. The order book shows:

- 10,000 buy orders at $50.50

- 5,000 buy orders at $50.25

- 3,000 sell orders at $51.00

- 2,000 sell orders at $51.50

- The significant buy-side imbalance at $50.50 suggests strong demand.

- It leads to upward price pressure.

- As buyers continue to place orders at this level, the price starts to rally.

- Traders who observe this imbalance:

- Anticipate the price movement

and

- Position themselves accordingly.

How to Identify Entry and Exit Points

Other than gauging market sentiment, traders also use order flow imbalance to determine optimal entry and exit points for their trades. To do so, they analyze the concentration of buy and sell orders. Let’s learn through an example in which a trader uses order flow imbalance to enter a long position.

Upon Analyzing the Order Book, a trader finds that:

- Current Price: $100

- Buy Orders:

- 15,000 shares at $100.50

- 10,000 shares at $100.25

- Sell Orders:

- 8,000 shares at $101.00

- 5,000 shares at $101.50

- Buy Orders:

Identifying Imbalance

The order book shows a significant imbalance. There are more buy orders at $100.50 and $100.25 compared to sell orders at $101.00 and $101.50. This position indicates:

- Strong buying interest

and

- It likely has upward price movement.

Setting Entry Point

- The trader decides to enter a long position at $100.50.

- They expect the strong buy-side imbalance to push the price higher.

- Hence, they place a market order to buy 1,000 shares at $100.50.

Monitoring the Trade

- After entering the trade, the trader continues to monitor the order book for any changes in the order flow imbalance.

- If the buy orders at higher levels increase and sell orders remain low, it reinforces the bullish sentiment.

Setting Exit Point

- The trader sets an exit point based on observed resistance levels.

- In this case, they choose $101.50since there is a significant concentration of sell orders here.

- They place a limit order to sell 1,000 shares at $101.50.

Executing the Trade

- As expected, the strong buy-side imbalance pushes the price higher.

- The stock price reaches $101.50.

- The trader’s limit order is executed, securing a profit.

3 Common Strategies Using Order Flow Imbalance

As discussed above, most traders use order flow imbalances to spot market sentiment and identify optimal entry and exit points. These benefits help in effectively executing three popular trading strategies:

- Scalping,

- Day trading, and

- Swing trading.

Let’s understand each strategy in detail:

Scalping Strategy

Scalpers aim to profit from small price movements, often holding trades for mere seconds to minutes. They often make quick trades based on short-term imbalances. Let’s learn the process:

Step I: Identify Order Flow Imbalance

- Use Level II quotes or a Depth of Market (DOM) tool to observe the order book.

- Look for a significant disparity between:

- Buy orders (bids)

and

- Sell orders (asks).

- This position indicates a buy-side imbalance.

Step II: Entry Point

- When a strong buy-side imbalance is detected (e.g., bid volume significantly higher than ask volume), enter a long position.

- Place the buy order slightly above the current best bid to ensure execution.

Step III: Execution

- Set a tight stop-loss to minimize potential losses due to the rapid nature of scalping.

- Aim for a small profit target.

- Usually, it is a few ticks above the entry price.

Step IV: Exit Strategy

- As soon as the price reaches the target, execute the sell order to lock in the profit.

- If the order flow imbalance starts to normalize or reverse, exit the position immediately.

Step V: Repeat

- Continuously monitor the order flow for new imbalances to repeat the process multiple times throughout the trading session.

Example

- Say a scalper notices an imbalance.

- There are 1,000 buy orders at $100.10 and only 500 sell orders at $100.15.

- The trader quickly enters a long position at $100.11.

- They set a stop-loss at $100.05 and placed a sell order at $100.13.

- The price rises to $100.13.

- The trader exits with a profit.

Day Trading Strategy

Day traders seek to capitalize on intraday price movements. They often use the order flow imbalance to identify:

- Trends

and

- Potential reversals.

This strategy focuses on spotting significant order flow changes that indicate market sentiment shifts. Let’s understand the process in simple steps:

Step I: Monitor Order Flow

- Use an order flow analysis tool to track the volume and direction of buy and sell orders throughout the trading day.

- Look for a substantial increase in sell orders compared to buy orders.

- This signals a potential sell-side imbalance.

Step II: Trend Identification

- Identify a developing downtrend characterized by consistent sell-side imbalances.

- Confirm the trend with additional technical indicators like moving averages or trendlines.

Step III: Entry Point

- Once a significant sell-side imbalance is detected (e.g., a surge in sell orders at a critical price level), enter a short position.

- Place the sell order just below the best ask price to ensure execution.

Step IV: Managing the Trade

- Set a stop-loss above a recent high or a key resistance level.

- This placement will protect against adverse price movements.

- Use trailing stops to lock in profits as the trend continues.

Step V: Exit Strategy

- Monitor order flow for signs of a:

- Diminishing sell-side imbalance

or

- A potential reversal.

- Exit the short position if:

- Buy orders start to outweigh sell orders significantly.

or

- The price approaches a support level.

Example

- A day trader spots a sell-side imbalance.

- There are 1,500 sell orders at $50.00 and only 700 buy orders at $49.90.

- The trader enters a short position at $49.95.

- They set a stop-loss at $50.10 and used a trailing stop-loss to ride the downtrend.

- The price falls to $49.60.

- The trader exits the position as buy orders begin to increase.

Swing Trading Strategy

For the unaware, as a swing trader, you aim to capture price swings over several days to weeks. To do so, you use sustained order flow imbalances to:

- Time your trades

and

- Ride the momentum created by persistent buy or sell-side imbalances.

Let’s learn how you can execute this strategy by analyzing order book imbalances.

Step I: Analyze Order Flow

- Use order flow analytics to identify sustained buy-side or sell-side imbalances over multiple trading sessions.

- Look for patterns indicating:

- Consistent accumulation (buying)

or

- Distribution (selling).

Step II: Entry Point

- When a persistent buy-side imbalance is observed (e.g., multiple days of higher buy order volumes), you should enter a long position.

- Place the buy order at a price level showing strong support.

- This placement will enhance the probability of execution.

Step III: Trade Management

- Set a wider stop-loss below a key support level.

- This order placement will let you account for market volatility over several days.

- Monitor the position daily.

- Adjust the stop-loss to lock in gains as the price moves in your favor.

Step IV: Riding the Trend

- Use trailing stops or technical indicators like moving averages.

- You can stay in the trade as long as the buy-side imbalance persists.

- Consider partial profit-taking at predetermined levels.

- This will help you secure gains while still participating in the uptrend.

Step V: Exit Strategy

- Imbalance reversals indicate a potential trend change.

- Hence, you should exit the position if the order flow imbalance reverses.

Example

- A swing trader observes a consistent buy-side imbalance.

- The volume of buy orders exceeds sell orders over several days.

- The trader enters a long position at $120.

- They set a stop-loss at $115 and monitored the trade.

- As the price rises to $130, the trader moves the stop-loss to $125 to protect their profits.

- The trader continues to hold the position until the price hits $135.

- They exit at this price level as the order flow shows increasing sell orders.

Advanced Techniques for Analyzing Order Flow Imbalance

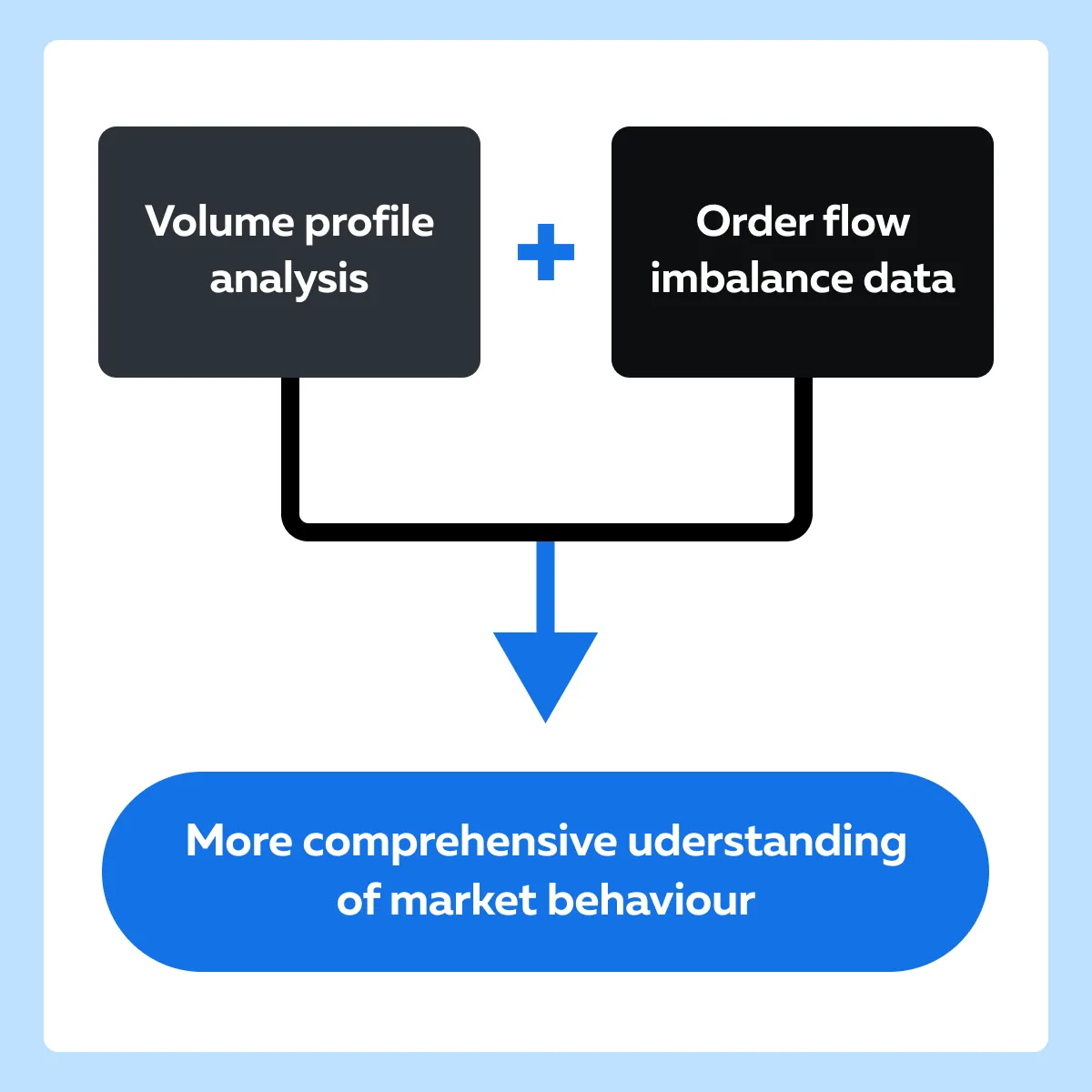

By using advanced techniques for analyzing order flow imbalances, you can gain deeper insights into market behavior and enhance your trading strategies. Two key methods to do so are:

- Volume profile analysis

and

- Heatmap visualization.

These techniques help traders identify key levels and quickly spot significant imbalances. Let’s study them in detail.

Volume Profile Analysis

Volume profile analysis is a technique that displays the traded volume at various price levels over a specified period. It is essential to note that by integrating volume profile analysis with order flow imbalance data, traders gain a more comprehensive understanding of market behavior.

Let’s understand how you can combine volume profiles with order flow data:

- Understand Volume Profiles

- Volume profiles show the distribution of trading volume at different price levels.

- High-volume nodes (HVNs) indicate price levels with significant trading activity, often acting as support or resistance.

- Low-volume nodes (LVNs) represent price levels with less trading activity through which prices may move quickly.

- Analyze Order Flow Imbalance

- Order flow imbalance data reveals the difference between buy and sell orders at various price levels.

- By overlaying this data on a volume profile, traders can see where imbalances occur relative to high and low-volume areas.

- Identify Key Levels:

- Traders can identify key support and resistance levels by combining these two analyses.

- For example,

- A high-volume node with a significant buy-side imbalance acts as strong support.

- Whereas a high-volume node with a sell-side imbalance may act as strong resistance.

For Example:

- Let’s assume a stock is trading around $150.

- The volume profile shows an HVN at $148 and another at $152.

- The order book shows:

- A buy-side imbalance at $148

and

- A sell-side imbalance at $152.

Now, a trader analyzing this data identifies the support and resistance levels in the following manner:

| Support Level | Resistance Level |

|

|

Heatmap Visualization

A heatmap graphically represents the concentration of buy and sell orders at various price levels. Several traders use this visualization to identify and analyze order flow imbalance. Let’s read about the major benefits of Heatmap visualization.

- Quick Identification

- Heatmaps use color intensity to represent the concentration of orders.

- Darker colors indicate higher concentrations.

- This makes it easy for traders to spot significant buy and sell orders immediately.

- Dynamic Analysis

- Heatmaps are updated in real time.

- They provide traders with real-time information on order flow imbalance.

- This dynamic analysis helps traders react quickly to changing market conditions.

- Highlighting Key Levels

- Heatmaps highlight key levels where significant buy or sell orders are clustered.

- These levels often act as support or resistance.

- They help traders make strategic decisions about entry and exit points.

Let’s understand the execution better using an example:

Consider a stock trading at $200. A heatmap visualization shows:

| Significant Buy Orders | Significant Sell Orders |

|

|

Using this information, a trader makes the following quick decisions:

- Entry Point:

- They are anticipating support and a potential price rise.

- They place buy orders near the price point of $198.

- Exit Point:

- They are anticipating resistance and a potential price drop.

- They place sell orders near the price point of $202.

Conclusion

Order flow imbalance is the difference between buy and sell orders at various price levels, which traders may analyze to gain an edge. When there are more buy orders at a given price, it indicates a bullish sentiment and potential upward price movement; vice versa, more sell orders suggest a bearish sentiment and potential downward price pressure.

Also, analyzing order flow imbalance helps identify optimal entry and exit points. Moreover, advanced techniques like volume profile analysis and heatmap visualizations further enhance the ability to interpret order flow data. These tools help traders quickly identify key support and resistance levels and make informed decisions in real time.

By incorporating order flow imbalance into trading strategies, whether for scalping, day trading, or swing trading, you can significantly improve the accuracy of your trades and potential profitability. To learn more about how to use order flow imbalances, visit Bookmap’s Knowledgebase.

Twitter

Twitter

Facebook

Facebook